Everybody knows what Travel Insurance is – it’s that thing that kiasu people buy before they go on a holiday, in case die or kena earthquake hor?

Or.. it’s that thing that airlines sneakily add into your fare (then you have to remember to uncheck the box, if not your GOOD DEAL airfare of $80 suddenly becomes $150++ , because of travel insurance, upgrades, seat selection, meals, yada yada)

and honestly, alot of people don’t buy travel insurance because we travel so often (#wanderlust #yolo #vacay) that we think – what are the odds of anything happening to us? Even an extra $25 not worth it!

I travel quite a fair bit, especially short trips, so i totally feel your pain (go batam ferry ticket only $48 but travel insurance $20+ very expensive leh!) But recently I’ve been able to appreciate travel insurance a little better.

So here’s 5 reasons why you SHOULD buy travel insurance (and how to use it).

#5. In the case of an accident/illness overseas, you don’t have to worry over the bills.

Let’s be honest, we like to do #yolo stuff and try new things when we are on holiday.

Hiking trips, adventure thrills, new food experiences – these are part of what makes our travels memorable. But hey, chances of minor (or major) accidents and sicknesses like food poisoning are not improbable right?

Even if you are statistically swearing by the probabilities of you getting an injury/sickness being almost negligible (pull out statistics of your gender getting injury overseas X age group X activity X place you travel to X what clothes you wear X your favorite color….), you can’t predict accurately as well.

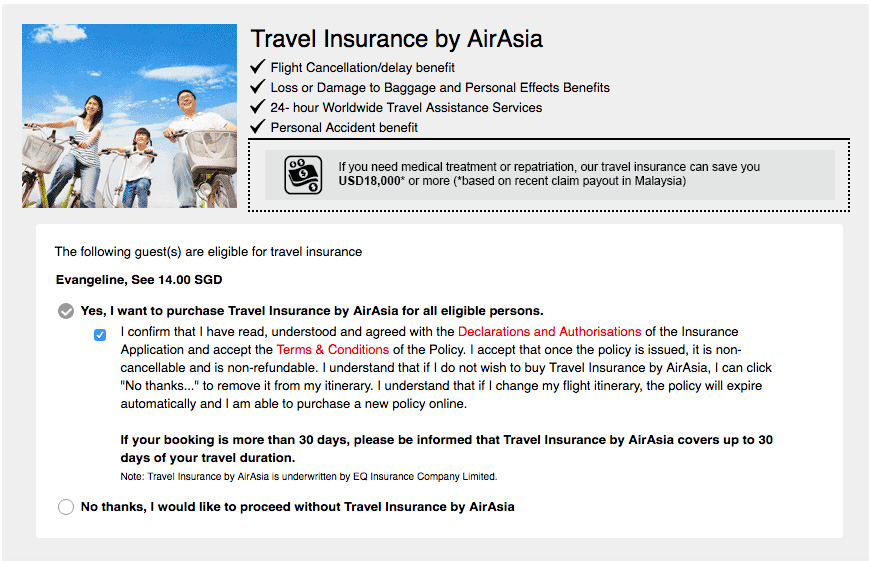

In my most recent trip, J got into a little accident on the road.

He ended up with a deep cut (to the tendon) in his finger and wounds all over his chest and arm. His first few questions to me was “Eh, can claim or not“.

After he knew that it was claimable, he was then comfortable to return to the clinic for the next few days to wash his wound, do an X-ray, and get more medicine. Even after returning to Singapore, he went to a clinic to check his wounds and get more medicine/dressing.

If it wasn’t claimable, he probably would be more worried about the costs.

To be honest, he was never really bothered about getting travel insurance, so I would usually get it for both of us.

Moral of the story: Ladies, if you have a boyfriend/husband who is stubborn, and occasionally acts like a little boy (especially when presented with scooters/thrilling activities…) buy travel insurance for them. Better be safe than sorry.

How to claim?

- keep all medical reports & original receipts

- if due to an accident involving another party (eg car accident), try to file a police report in that country and keep a copy of the report with you for submission

- download claim form from travel insurance website and fill in as required, submit reports, receipts as well as flight itinerary.

(Note: please always read the policy wording. If you are intending to rent a car overseas, you might have to pay a little more for the rider that covers damage to car in accident etc)

#4. Prevent yourself from feeling horribly shitty when your stuff gets stolen

It’s not uncommon for things to get lost or stolen during your travels – in some countries, it’s actually super common to get bags slit, wallets taken or slit. Especially nowadays many of us travel with cameras (for that perfect Instagrammable photo, of course), laptops and valuable items. Oh, and branded bao-baos (bags)

I had a *ahem*Coach*ahem* sling bag that I brought to Bangkok and someone had attempted to cut the strap (obviously not wear and tear since it quite a straight cut, and the other side is perfectly fine with no wear and tear at all). But since it wasn’t all the way, I didn’t notice it till after the trip, so by the time I did it was too late. serves me right loh

So that’s a reminder not to bring expensive stuff overseas and flaunt it, and always check your belongings!

How to claim:

- File a police report at the place of loss/theft (you will need this report to claim)

- Take pictures of the damaged item

- Download claim form from website and fill in details of loss as well as prices of the item (If possible, submit the receipt/invoices of the item. If you don’t have that, go online and find the item price, and submit that to help with the filing)

- Submit also the police report and flight itinerary!

#3. Flight/Baggage Delay? At least got $$$ 😀

Flight delays are crappy, especially flight delays which makes you miss connecting flights and all that annoying stuff. Sometimes the only thing to look forward to is.. claiming some money.

This allowance can help make you a little more comfy, like – extending your hotel room for half a day, buying a meal (or 3), buying a little present for yourself or whatever, it’s up to you.

And if your baggage is delayed, the compensation will cover the necessary items you had to buy in the interim like..toothbrushes or undies.

Before you get too excited, there ARE limits on compensation – such as $100 for every 6 hours up to max of $500.

How to claim?

- make sure you get a letter from the airline counter THERE acknowledging delayed flight/delayed baggage.

- Use the claim form from the website and fill it up, submit the letter from the airline as well as the flight itinerary.

*Once I didn’t manage to get the airline letter, but because they sent me updates via email on my flight delay, I used it as evidence, as well as the new flight itinerary (It was so delayed until they changed my flight details!) – that worked!

#2. It can be your SUPERHERO against natural disasters

Can it stop natural disasters from happening, or keep you safe from a natural disaster? No lah, of course. But should a natural disaster occur at the place you are supposed to go, travel insurance will compensate you for cancellation of trip – reimbursing the $$ you have already spent (hotels, flight…) up to a certain limit.

This is also applicable to other reasons for trip cancellation such as serious injury/illness to you (so you are unable to travel) or your loved ones.

BUT!!!!!! You must have bought the travel insurance BEFORE the news of natural disaster has been known.

#1. It’s REALLY not that expensive. REALLY.

If it’s a short trip to nearby, it might cost around $20, and if it’s further or longer, it might be more expensive. BUT since you’ve paid quite a bit for your precious holiday, don’t be stingy on this ok? You never know when you might need it, and not everyone has the power of social media to go viral and make airlines compensate their luggage claims (see link below lol)

Also, theres so many freeaking discounts on travel insurance ALL THE TIME.

35% off, 20% off, everything off !

(My best buy was travel insurance to Europe, 50% off at that time 😀 )

But bear in mind, cheap doesn’t mean good! Airline add-on insurances may be cheaper, but they usually only cover for stuff that happens ON FLIGHT, means you are uncovered for the rest of your holiday.

If you are a true Singaporean and must compare, don’t just compare price. Compare all the coverages and get one you are comfortable with.

Still don’t want to buy travel insurance? Up to you! No judging here 😀

Still can’t find one? Drop me an email at evannsee@gmail.com and I’d love to send you some quotes for travel insurance (I’m certified and licensed to provide quotes from AXA, MSIG & Liberty). Perks of getting it from me vs directly online? Sorry, mostly no additional discount, but at least I’m here to help you with claims and questions anytime (:

Disclaimer: This blog post is meant to share my experiences with travel insurance and a rough guide to it, it represents only my opinion as an avid traveller & wanderluster! Please still read your plans carefully and their own instructions on how to claim.

Spread the love and share it with your friends!!

Comments are closed.