So I’ve recently embarked on this huge journey, and I just wanted to document it as I go along, as well as share my experiences and tips with whoever who might be thinking about it too! After all, it is a HUGE and scary af step for a Singaporean – lifelong debt, here I come!

Why Resale?

Of course, before any of these began, I always thought I would settle down at 26 in a nice BTO 4 or 5 room flat, in a nice place some day. Which girl wouldn’t like a big house in a nice place?

After much discussion, we agreed to apply this year in May 2016. However, the BTO locations available were not that ideal for us. His parents stay at Pasir Ris, while mine at Dover – and staying somewhere like Punggol or Bukit Panjang would isolate us from the world, and make it difficult to commute to see our parents.

Location – meh

So we took the step to apply for Sales of Balance at Bukit Merah. Even though we had first-timer priority and the ratio was in our favor, we wanted to look around at other options (resale) because

- The units available for SOB were very spread out among many blocks

- Many blocks did not have good units left (only very low floors..)

- Price range was really big for the same category of flats.

So, even if we were able to bid for a unit, likelihood of getting one that we liked was slim.

So our resale journey began…

We started by just looking at listings on apps, like Propertyguru, 99.co, SRX to see the prices and what we were in store for. Only after some time, we decided to take the plunge and call up agents for an appointment to view the flats, and that’s when things got a little serious.

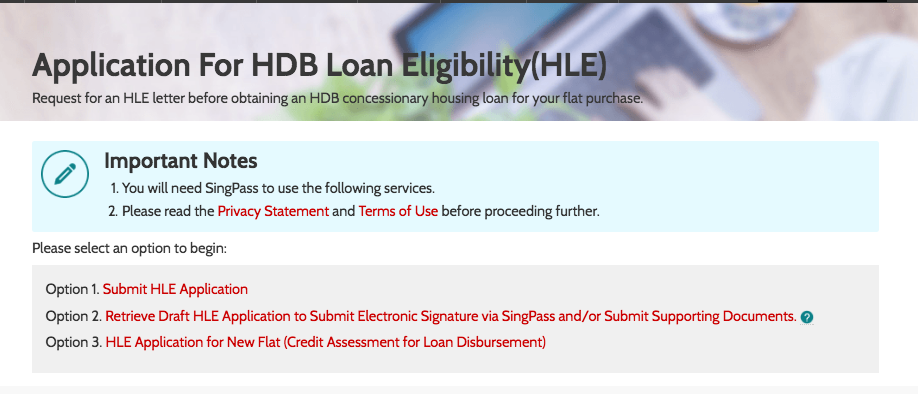

Tip #1: Get your HLE loan application + Budget consideration done before you start looking at houses.

The HLE loan basically takes into consideration your combined incomes (using your CPF contribution, payslips) to determine the max amount of loan you can take. If you are self-employed, it’ll be a little trickier as you need to submit Credit Report, bank statements and all that.

A mistake we made was to only rush into that after we saw a unit we liked. In the resale market, good units can get snapped up really fast, and you don’t want to lose out on your ideal place just because these are not ready.

Also look at the grants you are eligible for (First timer grant, income grant, proximity grant) so that you know which price range is affordable and practical for you.

Tip #2: Get an agent

We initially started the journey with the intention of not having an agent (save the 1% man!), and so we contacted agents ourselves, went down to view units and called HDB whenever we couldn’t figure out something. Ultimately we ended up with an agent we felt we could trust, and it really made the journey much smoother and less frustrating.

Here’s why:

- Many good units are not even listed on these apps, and many of the listings are outdated or “fake”

Most of the listings on the apps were either sold long ago, or never existed, but are simply used as “baits”. When you call in, they would tell you that it’s no longer available, but “are you interested in some other units in that area?” That’s how they bait you in.

After we decided to use an agent, most of the houses we viewed were not even listed on the apps yet. Many of these units were also actually snapped up before they were listed on the apps. Duh.

- Agents are more familiar with many of the rules and regulations

We had quite a difficult time with the regulations regarding CPF usage and remaining lease of the unit. And despite countless calls into HDB and CPF, it was still not that easy to grasp totally. These are the issues that good agents will take into consideration and help you manage.

- Much easier for agents to deal with seller agents

They have more experience to deal with seller agents than we do. Simply put, expressing interest on our side to the seller agent does not help the negotiation process. Why would the seller agent help us negotiate with the sellers if they could close at a higher price (and earn a larger cut?)

So that’s my own opinions on why I eventually decided that getting an agent would be good.

Update: For those asking who my agent was – he is Ken Koh from DWG (if you know him, say hi on my behalf!)

How do you know who is a good agent? In my humble opinion, a good agent is prompt in answering your questions and servicing you, as well as meticulous in educating you about the ropes of this process. Ultimately, he or she should not try to stretch your budget to get you to overcommit, and should never make you feel bad for not finding the right place. Your agent should also be on your side, and not act in his own interest. (Our agent actually stopped us from increasing our offer, despite being able to get a higher commission, because he knew the impact of the cashflow it would have on us. This is something we were definitely thankful for on hindsight.) Lastly, trust your instincts, we have them for a reason.

Tip #3. Narrow down your criteria.

Like all first-time home owners, we started off with a long long list of wants and ideals, especially when we got an agent (perform magic, yo!). These were the criteria we wanted

- Walking distance to MRT

- Green line between Dover to Paya Lebar

- Below $400,000

- Property more than 60 years remaining

- Not low floor (above level 6)

- Preferably corner unit

- 70sqm and above

But of course, our agent sat us down and made us prioritise. Managing expectations is important, both your own, as well as your parents.

After viewing units from Bedok to Holland, Commonwealth, Bukit Merah, Telok Blangah, we decided to narrow down our search to Dover because of:

- Proximity Grant of $20k (near my parents)

- Relatively near MRT

- Below $400K for a 3 room flat

- Property about 60 years remaining.

After this decision, the process became smoother, with us viewing units that were available, and just waiting for the right unit to come up!

TIP #4: Be prepared for each viewing

Things to ask and find out:

- Facing of the house: is it North-South facing? East-West facing will result in sun coming in (morning or afternoon) which will cause the house to be really hot and uncomfortable.

- How old is the house? When was the last renovation done? If the last reno was done more than 10 years ago, be prepared for a more extensive renovation.

- Previous owners – why are they selling? This gives you a bit of the background on the previous owners. If they are selling because they have got the keys to their next home, chances are that they are genuine and in need to close the sale soon.

- Neighbors – who are they? This is actually one of the most impt question that you can ask (and if you are very interested in the unit, come down to CSI for yourself). Do they burn incense everyday? Do they play mahjong? Are the units beside you tenanted out? Do they look well-kept?

- Potential for En-Bloc? This is just a bonus thing, if you are interested in it. There are many ways to speculate the potential for en-bloc (see blocks around you, space, height of block… google and read up!)

TIP #5: Interested? Don’t show your cards too obviously.

We were really interested in one unit. And because we knew it would be sold fast, we made 2 more viewing appointments for the next day, to bring each side’s parents down. Unfortunately, the sellers knew how interested we were, and hence refused to bargain or negotiate the price.

They eventually decided to wait a little longer to see if they could fetch higher prices than what they originally asked for. (These are non-genuine sellers, who will sit around to wait for better offers, as they are in no rush to sell).

TIP #6: Valuation

Even if you are willing to increase the price to secure your dream home, beware of valuation. If the units around you (similar block/floor) have been recently sold at $360k, chances are that your unit will also be valued at around $360k. If you had agreed to offer $390k, that would mean that you need to pay $30k in cash upfront.

That might not be a wise move, considering that you still need to expense for your renovation, wedding and all that jazz.

TIP #7: Make your financial plan

Buying a home is, of course, building a love-nest for you and your partner, but you don’t want it to become a financial burden.

Yes, a 3-room is small, but that would put us at about $1,200 monthly for 25 years. That’s an amount that is comfortable for us to continue with little treats and getaways every now and then, without worrying about the next payment. Should one of us be unemployed for awhile, it would also be less of a strain.

No matter how tempting it is to have a place as big as possible (especially since your peers are getting 4 or 5 room BTOs), understand what the trade-offs are before you commit.

TIP #8: STALK THE NEIGHBORS

Even after you have placed the option (or before), make multiple trips down to the unit on your own at varying times of the day. Do your homework to see if there are any problematic neighbor behaviors (blasting TV, Mahjong, loanshark activity). It’s your place for the next 5 -10 years at least – so do it!

TIP #9: Fees

Here are the fees you should take note of! Hope I remembered all of them

- Option fee: $1k

- Resale application: $80

- Valuation fee: $200

- Exercise Option: $1k

- Stamp Duties/Legal: About $5-6k (Depending on your cost of your house)

- Agent Fees: 1%

- Insurance: Depends.

TIP #10: Love it

Other than all the practical reasons for choosing a home, you need to love it and be able to imagine to spend your next many years in it. Explore the nooks and crannies, and imagine how you will spend time there.

It’s good to listen to the opinions of others (especially your parents) but ultimately, it’ll be YOUR home. Don’t buy it unless you love it.

xxx

So here’s where I am at! Part 1 down, and many parts to go!! Hope this will be useful to some of you, and cross your fingers for me (to finalizing the house and all the crazy reno stuff I will have to deal with!)

Like this post? Spread the love and share!

Like this post? Spread the love and share!

Comments

Hi, chanced upon your website and find your info on resale & rom very useful 🙂

I’m buying a resale flat with my fiancé too, but have yet to go for first appointment. May I ask if HDB required you to have ROM cert produced by completion date? Or did HDB request you to get married within a certain window period in order to get the resale flat keys and grant? Did you appeal for any extension?

Would appreciate it very much if you can provide any helpful info on this. Thanks 🙂

Hi Sorry for such a late reply! I totally missed this out. No, by your completion date they need your ROM date.

The only tricky thing is that the latest you can book your ROM date should be 3 months away. So technically you can ROM 3 months after your completion.

Another way around it would be to after completion, go onto ROM and try to change ur date to later (if you really need extra time!)

Thank you for your sharing, this is very helpful. We are looking for 3room resale also. Could you share more about the remaining lease? How did you decide the age of building you would like to get, whether it is newly built after 2000 or the ones not thatare 30 years plus? If you dont mind sharing.

Thanks